utah state solar tax credit 2020

What Is the Utah Solar Tax Credit Application Process Like. Extends a 1600 cap on maximum credits under the current credit system for residential PV systems until 2020.

Utah Solar Tax Credits Blue Raven Solar

Utah State Solar Tax Credit 2020.

. For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. State solar tax credit in Utah. State Low-income Housing Tax Credit Allocation.

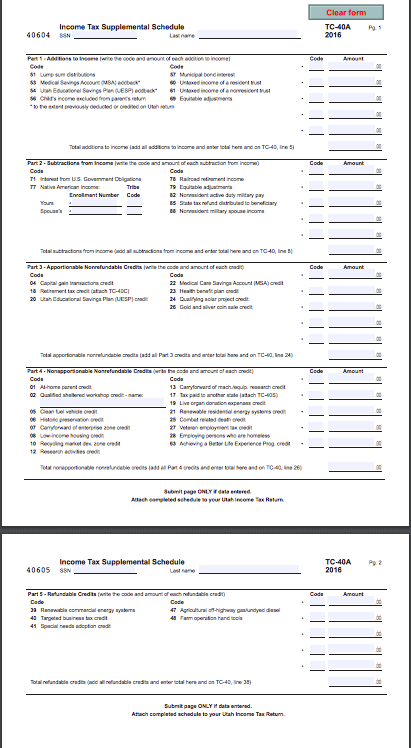

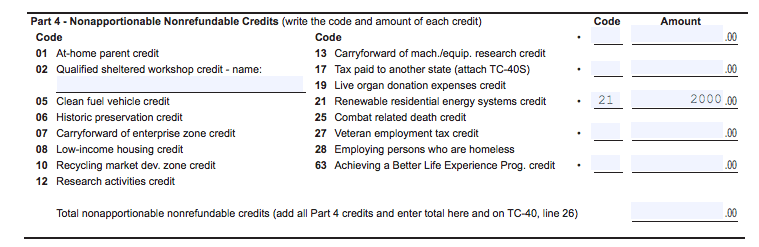

From 2018 to 2021 the maximum tax credit is 25 of system costs or 1600 whichever is lower. Welcome to the Utah energy tax credit portal. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential.

There is no tax credit on solar panels that you. Install your solar energy system by the end of 2020 and you can claim up to 800. 13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research.

We are accepting applications for the tax credit programs listed below. To claim your federal tax credit you are required to. Utahs RESTC program is set to expire in 2025.

Utah State Solar Tax Credit 2020. SB 141 Electric Energy Amendments. 17 Credit for Income Tax Paid to Another State.

For home PV installations completed in 2021 the Utah state ITC is limited to 400. As an example we will assume that the gross cost of your solar system is 25000. You can receive a maximum of 1000 credit for your purchase.

Utahs solar tax credit makes going solar easy. The Utah tax credit for solar panels is 20 of the initial purchase price. In 2020 the maximum tax credit was 1600 while in 2021 the maximum credit was 1200.

Summary of Utah Low-Income Housing Tax Credit. From 2018 to 2021 the maximum tax credit is 25 of system. As the policy stands.

12 Credit for Increasing Research Activities in Utah. These are the solar rebates and solar tax credits currently available in Utah according to the Database of State Incentives for Renewable Energy website. The SunPower brand name possesses sturdy origins in manufacturing and technician with numerous of its own components pre-dating its own huge.

In addition to the. Passed This bill preserves the Utah State Solar Tax Credit at 1600 through 2020 and is a huge advantage for residential solar installers. Commercial Tax Credits for Infrastructure.

While the 25 of eligible solar system costs will. After 2020 the cap will decline by 400 annually and eventually disappear.

Utah Solar Panel Installations 2022 Pricing Savings Energysage

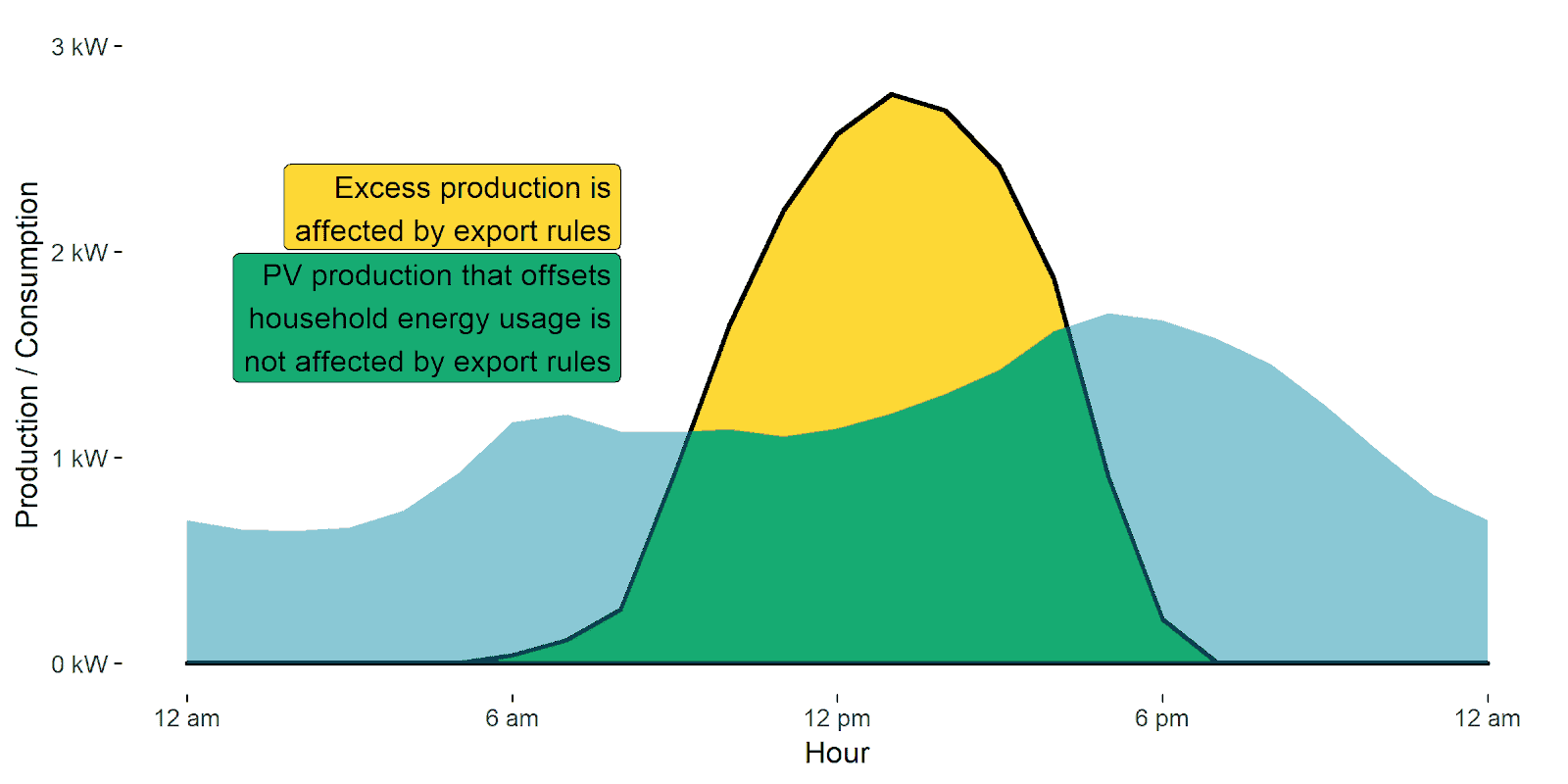

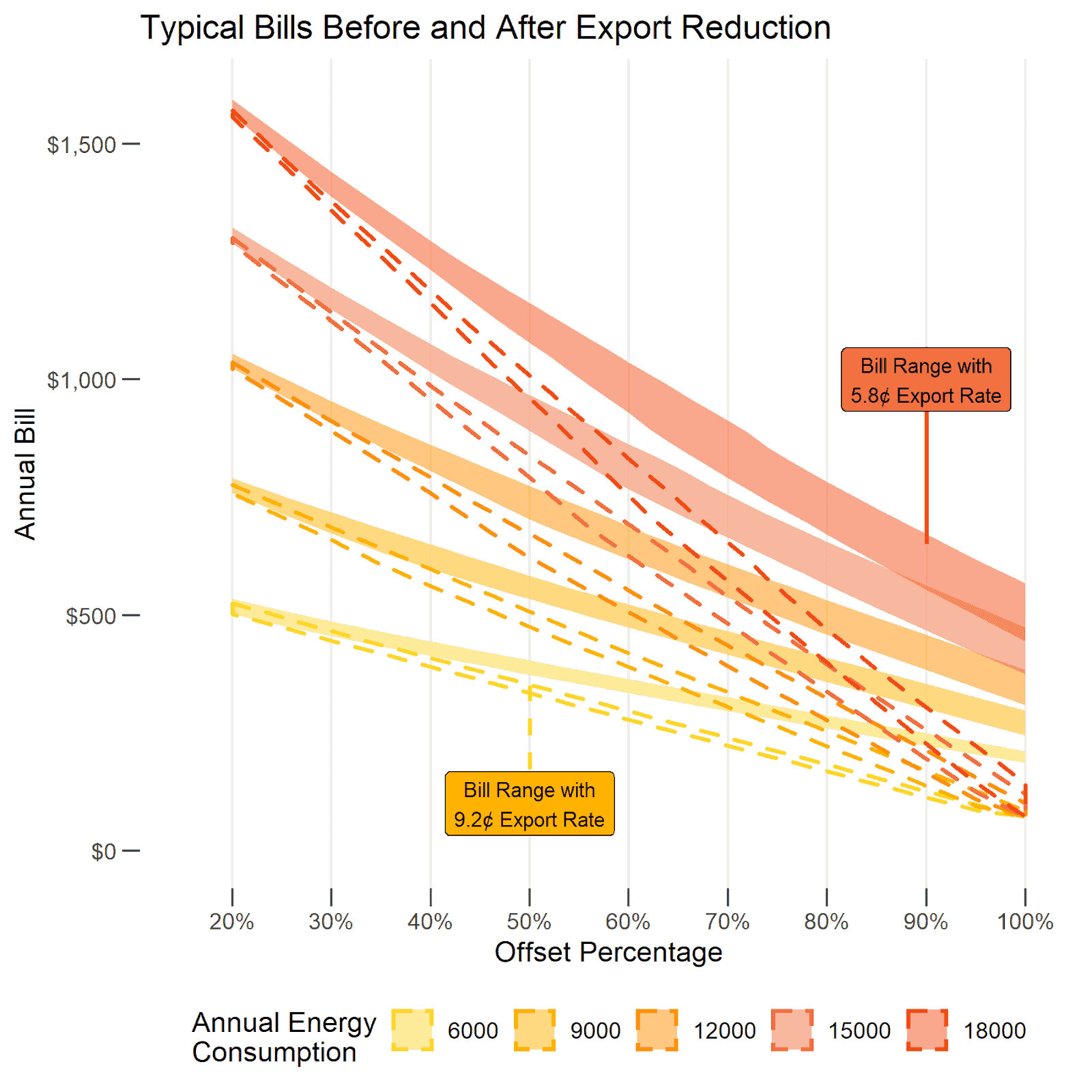

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

2022 Utah Solar Tax Credits Rebates Other Incentives

Utah Solar Tax Credits Blue Raven Solar

Utah S Largest Power Company And Solar Advocates Fight Over Rooftop Panels

In Utah Thousands Of Homes Feed The Grid Stored Solar Canary Media

Benefits Of Solar In Lehi Sunpower By Custom Energy

Utah Solar Utah State Incentives Prices Savings

2022 Utah Solar Tax Credits Rebates Other Incentives

University Of Utah Reaches 71 Renewable Energy With New Solar Contract Kutv

Hydro S Spanish Fork Plant Powered Completely By Renewable Energy

The Best Solar Companies In Utah Top Solar Installers In Ut 2021

Solar Incentives For Utah Homes Utah Energy Hub

New Solar Export Credits In Utah What The Changes Mean For Installers Aurora Solar

Understanding The Utah Solar Tax Credit Ion Solar